The post-pandemic evolution of office and multifamily

Throughout the pandemic, a familiar storyline emerged: Traditional office workers found themselves suddenly mobile, empowered by a fully remote work phenomenon brought on by the COVID-19 pandemic. The term “workcation” became mainstream as many chose to work remotely from the Sun Belt and other attractive locations popularized during the time of social distancing and lockdowns. While some corporations, including Goldman Sachs, Walmart, Bank of America, and Tesla, have called their workers back to the office, most—including tech giants Google, Amazon, and Microsoft—have staunchly affirmed their commitment to new hybrid protocols.

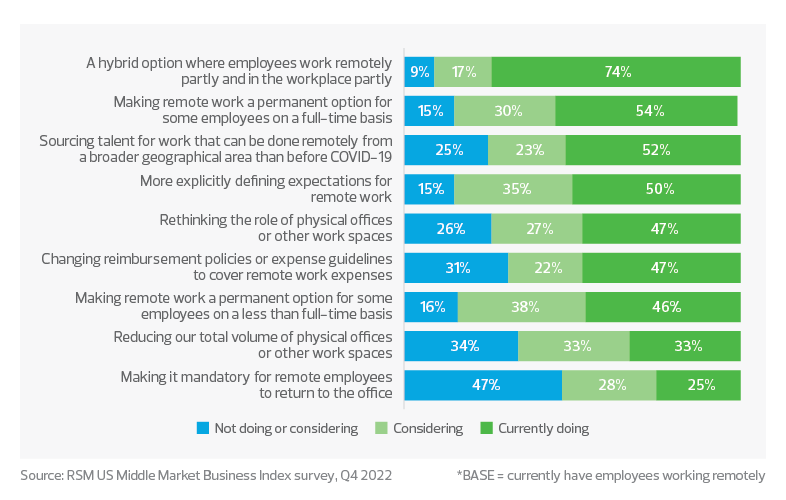

In fact, nearly three-quarters (74%) of middle market companies have rolled out a hybrid work option for employees, according to responses to workforce questions in RSM’s Middle Market Business Index survey for the fourth quarter. And only one-fourth said their organizations were requiring workers to return to the office.

It’s increasingly clear that the norms of work and residential life are being redefined in real time for real estate owners and operators.

Based on experience with people working remotely, which of the following is your organization currently doing or considering?*

Office reform hinges on flexibility

In the office realm, the primary challenge is meeting the expectations of all stakeholders—investors, business leaders, and employees. Surveys abound highlighting a disconnect in sentiment between employees and business leaders in the execution of the hybrid work model of the future, with leaders preferring an office-centric model and staff favoring being predominantly remote; however, the data also indicates that employees and business leaders alike are now prioritizing flexibility, collaboration, and digital investment.

Office investors have a unique opportunity to capitalize on this alignment by building the foundation of the office of the future, designing and retrofitting spaces to make use of flexible space, offering appealing open layouts that foster teamwork, deploying technology that allows both in-person and digital collaboration, and allowing tenants shorter-term leases based on usage or a revenue-sharing management agreement.

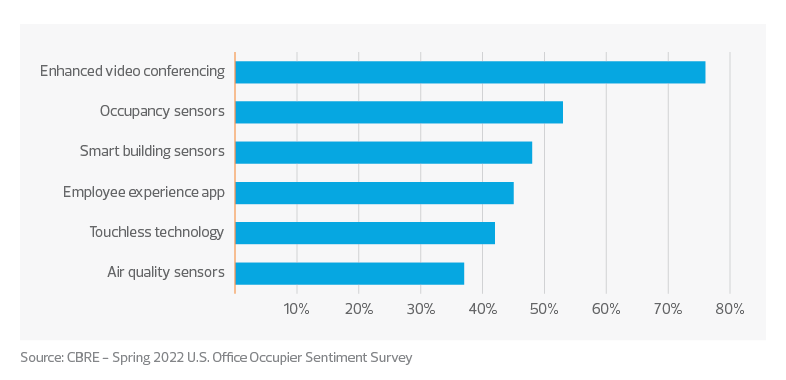

Which of the following commercial real estate technologies are you using or considering for the future steady state?

Flexible, home-centric future emerges in residential space

Adam Neumann, founder of coworking space WeWork, is placing another bet on flexible space—this time in the residential market. “Flow,” Neumann’s newest venture, is slated to bring experiential, purpose-built living to the residential market by offering furnished residences, flexible leases, and the promise of vibrant, connected communities. Set to launch next year, Flow is counting on the fact that the nomadic, work-from-anywhere trend unleashed by the pandemic is more than a passing fad. Its target population is younger workers, often in tech jobs, who split their time among several cities but still crave a sense of community. Neumann has amassed critical backing from anchor investor Andreessen Horowitz, which made a $350 million investment, reportedly valuing Flow at over $1 billion, according to The Real Deal.

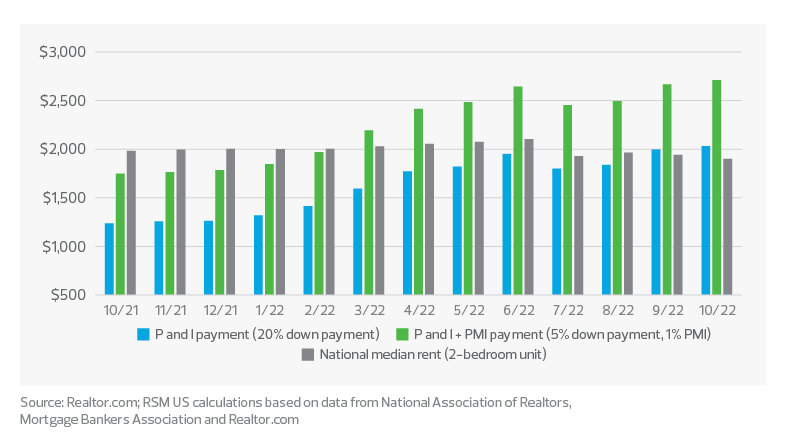

The flexible community isn’t the only strategy gaining momentum with investors; single-family rentals are increasingly popular as higher median home prices and rising mortgage rates, which hovered around 7% in November, now make purchasing a house more expensive than renting in markets across the United States.

Recent capital flows continue to chase opportunities in the single-family rental market, according to Yardi Matrix, which noted that through August 2022, institutional investors had committed more than $60 billion to buy single-family homes; Yardi pegged the growth on the build-to-rent market. Besides higher home prices, the rental trend is being fueled by the decline in new construction and housing starts and higher construction costs.

However, increasing interest in this space by institutional investors has met with resistance from federal policymakers. A meeting of the Oversight and Investigations subcommittee of the U.S. House Committee on Financial Services in late July focused on how expanding ownership of single-family rentals by institutional investors is putting affordable housing further out of reach for first-time homebuyers. Washington may indeed have cause for concern when it comes to future housing affordability: Research conducted this summer by MetLife Investment Management forecasts that by 2030, institutions will own more than 40% of all single-family rentals, eight times the estimated current 5% of the 14 million single-family rentals.

Monthly rent vs. monthly payment, median-priced home, 30-year mortgage

Technology is top priority for investors

Investment in technology has become critical not only for the future of commercial offices but also for multifamily and single-family rentals. Players in the residential rental space are focused on incorporating tech solutions to drive resident engagement, develop robust rental pipelines, manage revenue, and increase operational efficiencies. Priority investments include those that offer digital experiences for residents (keyless entry, environmental controls, communication with management, etc.) and that aggregate property-level data to enable proactive asset management through data analytics.

Market-leading public REITs point to investment in innovative technologies for margin improvement and future growth. Meanwhile, the proliferation of disparate smart home technologies has yielded platforms that unify Internet of Things (IoT) devices. One example is SmartRent, which enables multi- and single-family operators to manage remote access to smart devices throughout the tenancy life cycle: resident move in/move out, access to units for self-guided showings, routine maintenance and more. SmartRent and other solutions to manage remote access are a game changer for operators, allowing for reduced staffing that trims overhead and provides enhanced data analytics.

Market participants are looking to differentiate their properties with best-in-class technologies. They are gaining a front seat to emerging solutions through venture capital arms or partnerships with technology incubators, recognizing the importance of digital transformation to their ongoing success.

This article was written by Laura Dietzel, Sarah McKevitt, Troy Merkel and originally appeared on 2022-12-19 RSM Canada, and is available online at https://rsmcanada.com/insights/industries/real-estate/post-pandemic-evolution-office-multifamily.html.

RSM Canada Alliance provides its members with access to resources of RSM Canada Operations ULC, RSM Canada LLP and certain of their affiliates (“RSM Canada”). RSM Canada Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM Canada. RSM Canada LLP is the Canadian member firm of RSM International, a global network of independent audit, tax and consulting firms. Members of RSM Canada Alliance have access to RSM International resources through RSM Canada but are not member firms of RSM International. Visit rsmcanada.com/aboutus for more information regarding RSM Canada and RSM International. The RSM trademark is used under license by RSM Canada. RSM Canada Alliance products and services are proprietary to RSM Canada.

|

DJB is a proud member of RSM Canada Alliance, a premier affiliation of independent accounting and consulting firms across North America. RSM Canada Alliance provides our firm with access to resources of RSM, the leading provider of audit, tax and consulting services focused on the middle market. RSM Canada LLP is a licensed CPA firm and the Canadian member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries. Our membership in RSM Canada Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources. For more information on how DJB can assist you, please contact us. |