July 5th, 2024

Posted on February 4th, 2022 in Construction & Real Estate, Domestic Tax

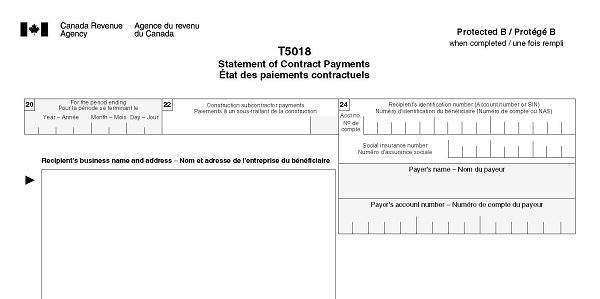

One of Canada Revenue Agency’s (CRA) strategies to combat the ever-growing underground economy is to require construction businesses to file an annual T5018 return. A T5018 Statement of Contract Payments Information Return, and slips, are required to be filed by any individual, trust or corporation with construction as their primary business activity (>50% of income earning activities are derived from construction) and have made payments to (or received credits from) subcontractors for construction services in excess of $500 in the year. CRA uses this information to identify subcontractors that do not file returns, report their full income, or are not properly registered for GST/HST.

If you file more than 50 information slips, you have to file them over the Internet (www.cra.gc.ca/iref). If you file fewer than 50 information slips, you may submit your information return electronically, or in paper format at the address provided on the back of the summary.

You can choose to do these slips either at your fiscal year-end, or at December 31st each year. Regardless of which reporting period you decide, you have 6 months from that date to file the slips. In order to change the reporting period you have selected, you will need approval from the CRA. If your business stops operating, you must file the information return within 30 days of the day your business ends.

If you fail to file an information return by the due date, a late-filing penalty may be assessed. Each slip is an information return and the penalty is based on the number of slips filed late. The penalty is the greater of $100 or a penalty determined as follows:

If you have not filed T5018’s in the past but were required to, CRA offers a voluntary disclosure program (VDP) to bring these filings up to date. Under this program, CRA will usually waive any late-filing penalties that would result from filing the returns past their due date. To be eligible for the VDP you must take action before CRA issues a demand to file the overdue return, the information return must be at least one year overdue, and the information being submitted must be complete. It is important to note that you are expected to bring your T5018 filings up to date for all insufficient tax years under a single voluntary disclosure.

For further information, or assistance with filing a T5018 Statement of Contract Payments Information Return, please contact your nearest DJB office.

Drop us a line, we look forward to hearing from you.