October 3rd, 2024

Private Companies: How a Professional Audit Can Help You Reach Your Goals

(authored by RSM CANADA) A private company may strengthen its financial stability, operational efficiency and long-term success by having a regular audit.

Posted on May 17th, 2022 in General Business

If you are an executor of an estate, one of the last questions that you will need to consider is applying for a Tax Clearance Certificate.

A Tax Clearance Certificate issued by the Canada Revenue Agency (CRA) confirms that all amounts owing to the CRA by the deceased and the deceased’s estate have been paid. The executor is free to distribute all assets of the estate.

If the executor distributes the estate assets to the beneficiaries without obtaining clearance, the CRA can hold the executor of an estate personally liable for any unpaid tax debts up to the amount distributed. This includes unknown taxes that come to light because of a future tax audit. For example, the CRA could decide to audit that unreported transfer of the family cottage to the next generation (which actually happened 15 years ago). If a clearance certificate has been issued then the executor is free and clear. If not, the CRA would then try to collect the unpaid taxes from the executor.

When an estate is ready for final distribution. This means that all tax returns for the deceased and the deceased’s estate have been filed, (re)assessed, and that any outstanding tax balances owing have been paid in full. Only then should the final Tax Clearance Certificate be requested.

The final Tax Clearance Certificate covers the period up to the designated tax wind-up date (date of the final T3 estate tax return). A final Tax Clearance Certificate covers both the deceased’s T1 tax returns and the estate T3 tax returns.

If T3 estate tax returns were not required, then you can request and obtain a date of death Tax Clearance Certificate. As the name suggests, a date of death Tax Clearance Certificate covers the period up to the date of death. It may be desirable in some circumstances to obtain a date of death Tax Clearance Certificate or an “interim” Tax Clearance Certificate where the final distribution of estate assets will not occur for several years.

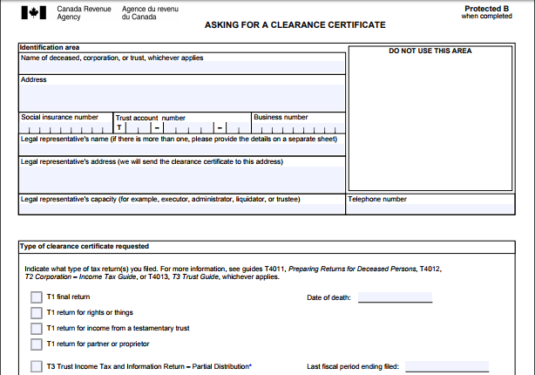

To request a Tax Clearance Certificate, complete Form TX19 – Asking for a Clearance Certificate and send it with the appropriate documentation to your local tax services office, “Attention: Audit – Clearance Certificates”. An authorized representative, such as a DJB accountant, can complete and file the TX19 on behalf of the executor(s).

As part of the TX19 submission, the following items are required by the CRA:

Even though in the majority of cases a Clearance Certificate is warranted, there are some situations where the executor(s) may be willing to live with the risk of not asking for clearance. After all, asking for clearance is inviting the CRA to review the tax filings. Where the executor is the sole beneficiary and confident that there are no potential tax issues, the executor may decide not to seek clearance. This is often the case when one spouse dies leaving their entire estate to the surviving spouse who also is the sole executor. There may be similar situations depending on the family dynamics and their tolerance for risk.

If you have any questions about this topic or any other estate matters, please do not hesitate to contact a DJB professional, we would be happy to answer your questions.

Drop us a line, we look forward to hearing from you.