April 15th, 2025

Short-term Rentals & GST/HST: The Hidden Tax Trap on Condo Sales

Switching to and from Airbnb or another form of short-term rentals can result in a GST/HST bill when a condo is sold or there is a change in use.

Posted on August 8th, 2023 in Domestic Tax, General Business

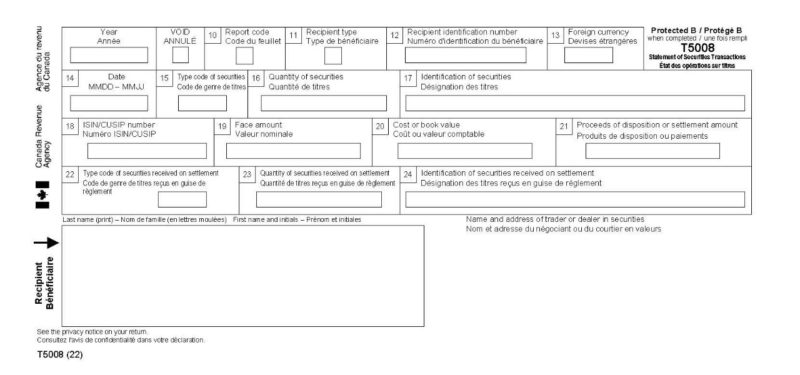

Traders or dealers in securities must report to CRA the disposition of securities, such as publicly traded shares, mutual fund units, bonds, and T-bills, of their clients on a T5008.

A November 4, 2022, French Federal Court case summarized CRA’s administrative policy where a taxpayer has not filed a tax return, but a T5008 was issued, reporting the disposition of property that does not include the cost of the property disposed. In this case, CRA will assess the taxpayer with unreported income by estimating the capital gain to be a percentage of the total proceeds of disposition based on the stock market performance for the year in question (details on how the calculation was made were not provided in the Court case).

In 2015, CRA applied this policy and assessed the taxpayer for his 2008 year with a $967,806 capital gain (taxable capital gain of $483,903) computed as 20% of all proceeds of disposition reported on the T5008. CRA assessed the taxpayer’s income for 2009 at $141,798. The taxpayer did not object to either of these assessments.

In 2019, the taxpayer filed his 2008 and 2009 returns reporting much lower income than CRA had assessed in 2015. As the 2008 return was filed (essentially requesting adjustments to the original assessment) more than 10 calendar years after the end of the year (December 31, 2008), no adjustments could be made to this year. The taxpayer relief provisions only allow an individual to request an adjustment up to ten calendar years after the relevant year. As such, CRA confirmed their 2015 assessment. The taxpayer then tried to argue that the excess of capital gains assessed by CRA over his actual gains for 2008 should be treated as a capital loss carried forward to offset his gains realized in 2009. CRA refused to reassess the 2009 return for this adjustment.

The Court found that the taxpayer could not indirectly reduce the impact of the capital gain on his 2008 return by claiming a capital loss on his 2009 return.

It is typical for brokers not to include the cost base of securities disposed on the T5008 as they may not have the accurate information. Also, even if an amount is reported on a T5008, the transaction may not always result in a gain; some dispositions may be in a loss or break-even position. For example, money market fund dispositions are often reported; however, there is normally no gain or loss.

ACTION ITEM: Ensure to report all gains from the disposition of securities fully; should dispositions not be reported, CRA may assess the taxpayer with unreported income much higher than the actual gain.

Contact one of our Taxation team members for more tax tips and advice.

Article originally published in: Tax Tips & Traps 2023 Second Quarter – Issue 142.

Drop us a line, we look forward to hearing from you.