February 20th, 2024

Posted on May 18th, 2023 in Financial Planning & Wealth Management

In times of economic turbulence, it’s normal to feel apprehensive when you’re about to read your portfolio’s performance. And, of course, seeing the fluctuating short-term results doesn’t help. It is more important to keep your sights on the bigger picture and stay focused on your long-term investment strategy and performance. By doing so, you can navigate the choppy waters of the current economic climate more confidently and ultimately achieve your financial goals.

Typically, volatility is a short-term issue; in the long run, your long-term investment plan and confidence in your investment holdings matter. Therefore, avoiding short-term “noise” can be a good strategy. While performance is undoubtedly crucial, it should be evaluated in years, not months.

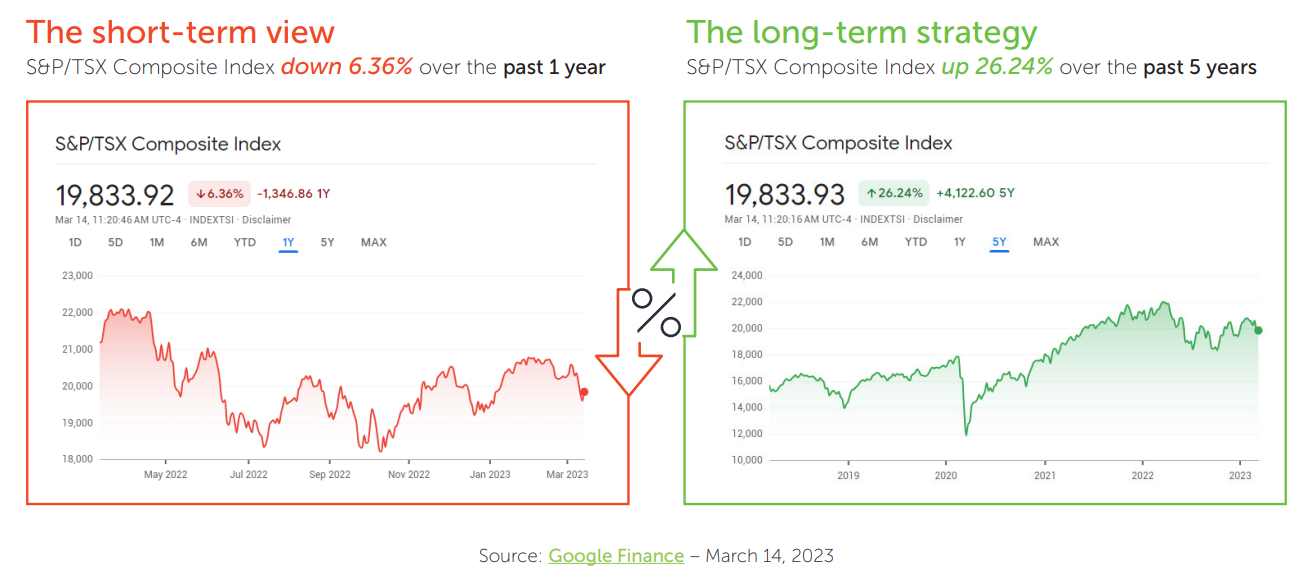

For example, take a look at it in graph terms:

The performance figures can be an unpleasant surprise, depending on the period you are looking at or the duration being reported on your account statements.

Consider:

Imagine thinking about your investment portfolio as if it were your own home. This relatable comparison can help you weather market downturns with greater ease.

Unlike your monthly investment statement, you don’t receive regular updates on your home’s value nor see real estate index numbers fluctuating in real-time. This lack of daily stress means that when the value of your home drops, you don’t immediately consider selling it. After all, your home is a long-term investment and a significant part of your net worth.

Similarly, selling off your stocks doesn’t make sense just because the market is down. Likewise, jumping out of the market and buying back once values have risen is not a sound strategy. Instead, stay the course

and trust in your long-term investment plan.

We will always have periods of volatility. It’s important to keep calm and avoid knee-jerk reactions that may jeopardize your long-term plan. Review your portfolio and strategies with your Accountant, Financial Planner, and Portfolio Manager, and gain the confidence you need to stay the course.

![]()

Drop us a line, we look forward to hearing from you.