With rampant inflation and growing interest rates, Canadians everywhere are bracing for a looming recession. The interest rates applicable for tax planning in Canada have been increasing as well, leaving many tax decisions that once made sense to now being much tougher to manage economically. Interest rates applicable for tax planning refer to the prescribed interest rates, which are computed quarterly and published online by the Canada Revenue Agency (CRA).

This article is the second article in the series with a focus on the impact of increasing prescribed interest rates on certain tax-planning loans. You can find the first article here, which discusses how increasing prescribed interest rates impacts income tax reassessments.

Employer-provided home purchase loans

Under certain employment circumstances, employees are able to take advantage of low-interest loans offered by their employers to purchase a dwelling. These housing loans have certain beneficial tax attributes, including that the loan itself would not be considered employment income. Rather, the employee would only have taxable income inclusion equal to the prescribed interest rate times the principal amount owing less any interest actually paid on the loan.

The prescribed interest rate on these types of loans is fixed at the rate at the time the loan was made. Therefore, if the loan was first made a few years ago, it would still be fixed at the prescribed interest rate of 1%. However, there is a mandatory 5-year “refresh” on home purchase loans, deeming a new loan to arise at that time. This means that any housing loans previously taking advantage of historically low prescribed interest rates may soon be up for a refresh at current prescribed interest rates.

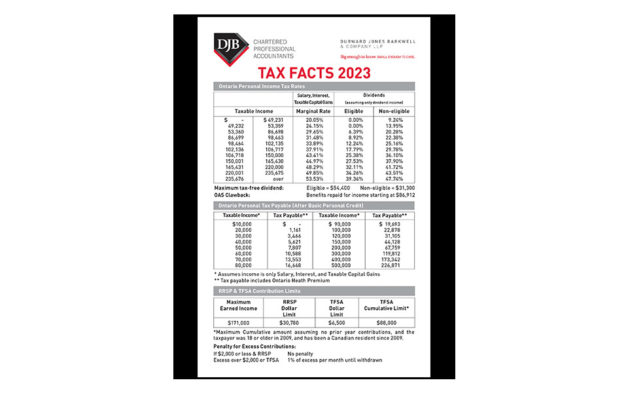

As an example, assume there was an outstanding home purchase loan issued to an employee for $250,000 on January 1, 2018, requiring to be repaid by January 1, 2028. The loan did not require any interest to be paid and the employee was including $2,500 (1% prescribed interest rate times $250,000) in their taxable income each year since 2018. On January 1, 2023, there was a mandatory refresh of the loan, meaning it now carries the Q1 2023 prescribed interest rate of 4%. Assuming there has been no principal repayments yet, the inclusion to taxable income for 2023 has now increased to $10,000 (4% prescribed interest rate times $250,000). Depending on the employee’s marginal tax rates this could mean an increase of taxes owing of almost $4,000.

Taxpayers who may be affected by this mandatory refresh should start considering if it still makes financial sense to have the home purchase loan or if they should refinance.

Prescribed rate loans

A common way to avoid adverse tax implications on certain types of loans is to have the loan carry the prescribed interest rate. For example, individuals can generally borrow funds from a corporation they own for a short term at the prescribed interest rate and only need to include that interest in their taxable income. These type of financing options may have historically been effective, but given the recent increases to prescribed interest rates, this may no longer be a sound strategy.

Prescribed rate loans are also used in income splitting strategies for high-net-worth families by utilizing a family trust to hold income-earning securities. The trust then distributes the income earned to its beneficiaries, typically minors or a spouse, to attempt to split the investment income earnings across taxpayers with lower marginal tax rates. While this strategy can be thwarted under certain circumstances, one way to make sure the planning works as intended is to utilize a prescribed rate loan. Typically, this involves a high-income-earning family member to loan funds to the family trust at the prescribed interest rate.

In contrast with home purchase loans, there is no mandatory refresh of these loans. Instead, these loans remain outstanding indefinitely as long as the taxpayer continues to meet the relevant criteria. This means that taxpayers are incentivized to enter into these loans when the prescribed interest rate is as low as possible. The reason for this is because the interest paid on the loan is taxable to the creditor, typically the high-income-earning family member. As such, the higher the interest rate, the larger the income inclusion to an individual likely already at the highest marginal tax rate.

If taxpayers were interested in utilizing this type of planning right now, they have until March 30, 2023 to lock in the current prescribed interest rate of 4%. Despite the rate being relatively high, economically is still may make sense to take advantage of this planning. For example, assume that a high-income-earning family member paying tax at a marginal rate of 50% has $500,000 of excess cash they would otherwise have invested themselves in a security that yields 6% annually. They could consider a prescribed rate loan plan where they lend the $500,000 to a family trust at an interest rate of 4% which would then invest in a security that yields 6% annually.

If the taxpayer loaned the funds on January 1, 2023, the following tax results would occur for the 2023 taxation year:

|

|

High-income-earning family member

|

Family trust

|

|

Revenues

|

Interest income on loan: $20,000

($500,000 x 4%)

|

Security yield: $30,000

($500,000 x 6%)

|

|

Expenses

|

–

|

Interest expense on loan: $20,000

($500,000 x 4%)

|

|

Net income

|

$20,000

|

$10,000

|

|

Approximate tax owing @ 50%

|

$10,000

|

–

|

Absent this planning, the high-income-earning family member would have earned $30,000 on the security themselves and pay an approximate tax of $15,000. The planning has effectively saved approximately $5,000 of taxes annually ($30,000 * 50% vs $20,000 * 50%).

The take-away

Tax planning involving loans is not static, it requires constant attention and reevaluation of effectiveness regularly. Even if a plan made sense a certain time ago, changes in economic circumstances can change that drastically.

This article was written by Daniel Mahne and originally appeared on 2023-03-24. Reprinted with permission from RSM Canada LLP.

© 2024 RSM Canada LLP. All rights reserved. https://rsmcanada.com/insights/services/business-tax-insights/managing-increasing-prescribed-interest-rates-on-loans.html

RSM Canada LLP is a limited liability partnership that provides public accounting services and is the Canadian member firm of RSM International, a global network of independent assurance, tax and consulting firms. RSM Canada Consulting LP is a limited partnership that provides consulting services and is an affiliate of RSM US LLP, a member firm of RSM International. The member firms of RSM International collaborate to provide services to global clients but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmcanada.com/about for more information regarding RSM Canada and RSM International.

The information contained herein is general in nature and based on authorities that are subject to change. RSM Canada LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM Canada LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.