On May 15, 2025, Ontario’s Minister of Finance, Peter Bethlenfalvy, presented the 2025 Ontario Budget – A Plan to Protect Ontario. The province’s budget includes the following tax measures:

Business Tax Measures

Corporate income tax rates

Ontario’s corporate income tax rates have not changed.

Ontario tax deferral

The budget provides businesses a reminder that the payment of select provincially administered taxes (e.g. employer health, gas, fuel, and others) may be deferred for six months, from April 1, 2025, to October 1, 2025. Although penalties will not apply for missed payments during this period, there is no deferral of tax return filing deadlines.

Ontario made manufacturing investment tax credit (OMMITC)

The refundable tax credit has increased from 10% to 15% on up to $20 Million of eligible investments per taxation year. Therefore, the maximum credit will increase from $2 Million to $3 Million per taxation year. The $20 Million limit must be shared amongst an associated group of corporations and will be prorated for short taxation years. Eligible investments include buildings and equipment used in manufacturing and processing (M&P) in Ontario, that are acquired and become available for use on or after May 15, 2025, and before January 1, 2030.

The credit has been extended to non-Canadian-controlled private corporations (“non-CCPCs”), which have a permanent establishment (“PE”) in Ontario. Non-CCPCs are eligible for a non-refundable tax credit (“NRTC”). Any unused NRTC’s could be carried forward up to 10 taxation years and applied against taxes payable.

The budget includes a repayment of the credit where after May 14, 2025, the eligible capital property is sold, converted to non-M&P use, or removed from Ontario within five years. The repayment amount would be the lesser of:

- The total value of the credit; and

- The credit amount relative to the value of the property at the relevant time.

Ontario shortline railway investment tax credit (OSRITC)

The budget introduces a 50% refundable tax credit for capital property (included in capital cost allowance classes 1, 3, or 13) and labour expenditures on railway-related maintenance made on or after May 15, 2025, and before January 1, 2030, by qualifying corporations. A qualifying corporation must be licensed either provincially under the Shortline Railways Act (Ontario) or federally (class II & III) under the Railway Safety Act and must have a PE in Ontario. The credit will be limited to $8,500 per track mile in Ontario and the labour expenditures are limited to railway track maintenance expenditures paid to individuals who are residents of Ontario for work performed in Ontario.

Personal Tax Measures

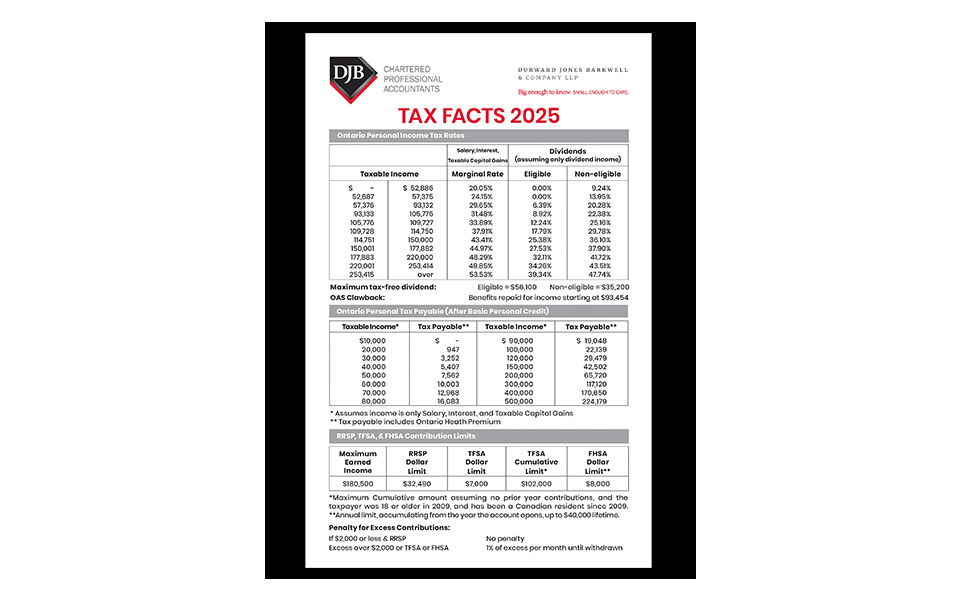

Personal income tax rates

Ontario’s personal income tax rates have not changed.

Ontario fertility treatment tax credit

The Ontario government has introduced a new fertility treatment tax credit effective January 2025, aimed at helping individuals with the costs of fertility services. The credit will cover 25% on up to $20,000 of eligible fertility- and surrogacy-related expenses, with a maximum tax credit of $5,000 per year. Eligible expenses include in vitro fertilization (IVF) cycles, fertility medications, diagnostic testing, and travel for treatment. This credit is available in addition to the non-refundable federal and Ontario medical expense tax credits for the same eligible expenses.

Other Tax Measures

Changes to Gas and Fuel Tax

Effective July 1, 2025, the tax on propane used in licensed road vehicles will be eliminated.

Additionally, the Ontario government has made permanent the reduced tax rate of 9¢ per litre on gasoline and fuel, which had previously been lowered from 14.7¢ for gasoline and 14.3¢ for fuel. These temporary reductions were originally set to expire on June 30, 2025.

Changes to Alcohol taxes

Effective August 1, 2025, the Ontario government is proposing amendments to the Liquor Tax Act, 1996 that would reduce alcohol-related tax rates. The spirits basic tax rate would be lowered from 61.5% to 30.75%. For Ontario microbrewers, the beer basic tax rates would be reduced from 35.96¢ to 17.98¢ per litre for draft beer, and from 39.75¢ to 19.88¢ per litre for non-draft beer (with transitional rules applying). Additionally, the refundable corporate Small Beer Manufacturers’ Tax Credit (SBMTC) will be adjusted to reflect these new rates, offering enhanced relief to qualifying corporations for eligible sales occurring after July 31, 2025.