Category: General Business

When the Auditor Comes Knocking

Say the word ‘audit’ and people instantly become nervous. Relax, it doesn’t have to be this way. Just because you receive an audit notice, do not assume you have done something wrong. The Canada Revenue Agency (CRA) and the Ministry of Finance (MOF) periodically conduct audits on both personal and corporate taxpayers. CRA has up to three years from the mailing date of your notice of assessment to conduct an audit. For a Canadian controlled private corporation, the MOF has 4 years. After this time, the particular year is statute barred unless there is a case of fraud, in which case there is no time limit to the period for audit.

If you receive notice from the government stating you have been selected for audit, it would be wise to contact your professional advisor to discuss the letter. He/she should be able to advise what you need to provide to the government. The CRA’s normal course of action is to allow 30 days to comply with these letters. If you have a problem meeting this deadline, it is prudent to phone them and ask for an extension. These notices should not be ignored and you must comply with their request within the time allowed!

Regardless of whether your records are manual or computerized, the CRA will want to see your documentation. They may request access to your electronic records as well as original source documents. Generally, you must retain books and records for six years before destroying them in case the CRA requests any information to support your filing position.

Without a doubt, the best way to arrive at a positive outcome during your audit is for you to have a good set of accounting records that are backed up with invoices, cash receipts, payroll records, automobile log books and any other source documents that can verify both the sales and expense figures as well as any asset purchases. Without backup invoices to support your accounting records, you will be at the mercy of the auditor.

You should always treat the government auditor in a respectful manner and they should respond in similar fashion. If the CRA asks you any questions, it is advisable to answer them in a brief but straight forward manner. Sometimes the wrong answer is given unknowingly because you do not fully understand the question. You may wish to have your professional advisor present at any session with the government auditor to ensure that the questions are interpreted and answered correctly.

Overall, if you maintain good accounting records, you should not have too many issues to cause you trouble during an audit. Using your professional advisor to deal with the audit will likely help you to arrive at a better outcome than trying to do it yourself unless you have a professional on your staff that has experience in dealing with the CRA. So if you receive an audit notice, feel free to contact your local DJB office for advice.

Annual Financial Statement Preparation – What Are My Options?

All corporations, for-profit and not-for-profit, must prepare annual financial statements to accompany their tax filings with Canada Revenue Agency. However, determining the “type” of financial statements you engage your external accountant to prepare will vary depending on your organization’s specific circumstances.

In the not-for-profit world the requirements for financial statement preparation are mandated by the enacted Not-for-profit Corporation’s Acts, but directors and shareholders of for-profit corporations have much more flexibility and freedom when making their annual decision on the type of financial statements they wish to have their external accountant prepare. For further reading, please see our article on financial statement requirements specifically for NFPOs –Do We Need an Audit? An Overview of Not-for-Profit Organizations and Their Financial Statement Requirements

There are three levels of work that can be performed on a set of annual financial statements. The level of work performed by the corporation’s external accountant will vary depending on the shareholder’s specific needs and if the financial statements will be relied upon or distributed to external users such as the bank or potential investors or purchasers. Generally, these external users will want to ensure sufficient work has been performed on the financial statements by your independent external accountant to obtain a level of confidence they are relying on accurate and complete information.

Compilation Engagement Report

A Compilation Engagement Report is generally prepared when there is no intention for the financial statements to be used or relied on by external parties (unless specifically allowed by your lenders/creditors). In these engagements, the external accountant simply takes the balances provided by the corporation’s management and formats them into standard financial statement form. Minimal work is done by the external accountant to ensure the figures are accurate, and there is no requirement that the balances are reported based on any specific set of accounting rules or framework, such as Accounting Standards for Private Enterprises (ASPE) or International Financial Reporting Standards (IFRS). Since limited work to determine accuracy is performed by the external accountant and no assurance is given, fees for preparation of a Compilation Engagement Report are the lowest compared to the other two options.

When it makes sense for a Compilation Engagement Report:

- No external users

- Typically needed for tax compliance filing

- Desire to keep costs low

- No assurance required on balances reported

Review Engagement Financial Statements

The second type of financial statements provides users with limited assurance that nothing has come to the attention of the external accountant that causes them to believe that the financial statements do not present fairly, in all material respects, the financial position and results of the corporation. The external accountant is able to provide this limited assurance conclusion as the work they perform is more involved than when preparing a Compilation. This includes applying analytical procedures on reported balances and making inquiries of management and others within the entity to corroborate the reported balances. Generally, Review Engagement financial statements are prepared when there will be external users relying on the financial statements. This may be in situations where the corporation has moderate external financing and must report to the lender to ensure any financial covenants of the lending agreement are met. Review Engagement financial statements may also be requested by non-active shareholders to help give them some comfort on the results being reported by management. Unlike a Compilation, Review Engagement financial statements must follow an agreed upon accounting framework, such as ASPE, and will include additional disclosures not typically found in Compilations. These disclosures give information to the users of the statements and allow them to further assess the reported balances. Additional disclosures would include a Statement of Cash Flows, as well as Notes to the Financial Statements. The additional procedures performed by the external accountant along with the additional financial statement disclosures makes a Review Engagement financial statement a more expensive option than a Compilation.

When it makes sense for Review Engagement Financial Statements:

- Statements to be distributed to external users

- Typically required with moderate debt levels

- Non-active shareholders

- Limited assurance on reported balances desired

Audited Financial Statements

An Audited Financial Statement provides users with an opinion that the financial statements present fairly, in all material respects, the financial position and results of the corporation for the period being reported on. In addition to the analytical procedures and inquiries of management performed in a Review Engagement, the external accountant plans and designs audit procedures to test areas where risks of material misstatements specific to the corporation and its industry are significant. Examples of these procedures would include physically inspecting assets and confirming reported balances with third-parties. The auditor also considers the design and implementation of the corporation’s internal controls in order to design audit procedures that are appropriate in the circumstances. Similar to Review Engagement Statements, Audited Financial Statements must follow a specific accounting framework. Due to the extensive work required to give an audit opinion, the fees for Audited Financial Statements are the highest of the three options.

Generally, owner-managed corporations do not require Audited Financial Statements unless requested by their lender.

When it makes sense for Audited Financial Statements:

- Statements to be distributed to external users

- Typically required with higher external debt levels

- Non-active shareholders

- Required by law or regulation

Determining the appropriate type of financial statement you need in any given year will depend on your specific circumstances. We recommend discussing this with your external accountant as early as possible to ensure appropriate planning steps are taken at/around your corporation’s year end date to allow for a cost-effective financial statement preparation process.

Liberal Election Platform: Potential Tax Related Changes

With the most recent federal election resulting in a Liberal minority government, individuals and businesses should be aware of their tax-related platform proposals, as summarized in the listing below. Many are broad and lack detail, and some were previously announced by the former government.

Business items included:

- reintroducing the Multi-Unit Rental Building (MURB) tax incentive for home builders (first introduced in the 1970s);

- broadening the critical mineral exploration tax credit by expanding qualifying minerals to include critical minerals necessary for defence, semiconductors, energy, and other clean technologies;

- expanding eligible activities under Canadian exploration expenses to include the costs of technical studies, such as engineering, economic, and feasibility studies for critical minerals projects;

- modifying the clean technology manufacturing investment tax credit to include critical mineral mine development expenses for brownfield sites while expanding the list of priority critical minerals;

- extending the Carbon Capture, Utilization and Storage (CCUS) investment tax credit to 2035; • reinstating the CCA accelerated investment incentive, including immediate expensing for manufacturing or processing machinery and equipment, clean energy generation, energy conservation equipment, and zeroemission vehicles;

- increasing the claimable amount under the Scientific Research and Experimental Development tax incentive program (SR&ED) for Canadian companies to $6 million (from $3 million);

- establishing a Canadian patent box which, according to the costing submission made to the Parliamentary Budget Officer, would carry a tax rate that is half of the current federal corporate income tax rate on income derived from certain types of intellectual property, effective July 1, 2025;

- expanding the flow-through share regime to include certain startups, allowing investors to deduct eligible R&D expenses directly;

- reducing/removing interprovincial trade barriers and achieving mutual recognition of credentials; and

- introducing a 20% Artificial Intelligence (AI) deployment tax credit for small and medium-sized businesses in respect of qualifying AI adoption projects, if the taxpayer can demonstrate that the AI expenditure increases jobs.

CRA items included:

- introducing automatic tax filing, starting with low-income households and seniors;

- leveraging technology to better identify and prosecute instances of tax evasion, fix loopholes, and strengthen enforcement; and

- collecting an additional $3.75 billion from increasing penalties and fines over a three-year period.

Capital gains/losses items included:

- cancelling the proposed increase to the capital gains inclusion rate, thereby retaining the 50% inclusion rate.

Corporate tax items included:

- conducting a review of the corporate tax system based on the principles of fairness, transparency, simplicity, sustainability, and competitiveness.

Employment items included:

- expanding the labour mobility tax deduction to cover tradespeople who travel more than 120 km from their home to a job site (currently 150 km), as well as significantly increasing the per-year tax deduction limit (no amounts were provided);

- supporting workers affected by US tariffs by implementing various EI measures; and

- enhancing the EI system to better reflect the modern workforce with flexible support.

Estate planning items included:

- reducing the minimum amount that must be withdrawn from a Registered Retirement Income Fund (RRIF) by 25% for one year; and

- increasing the guaranteed income supplement (GIS) by 5%.

GST/HST items included:

- reducing GST costs for first-time homebuyers by eliminating the GST on homes up to $1 million and reducing it on homes between $1 million and $1.5 million.

Personal items included:

- reducing the marginal tax rate on the lowest tax bracket by 1%; • reviewing and reforming the process to apply for the Disability Tax Credit (DTC);

- introducing an apprenticeship grant of up to $8,000 for registered apprentices (it would convert to an interest-free loan if the program was not completed) in addition to the current $20,000 interest-free loan provided to apprentices; and

- introducing a refundable health care workers hero tax credit for personal support workers valued at up to $1,100 a year.

Watch for developments in these areas!

Automatic Change to Electronic Mail for Businesses: Action Needed

As of June 16, 2025, CRA changed the default correspondence method for most businesses to online only (i.e. not delivered by paper mail). As business correspondence is presumed received on the date that it is posted online to CRA’s My Business Account, it can be problematic if correspondence requiring action goes unnoticed.

To receive notifications that mail has been posted online, the taxpayer must provide CRA with an email address and register that address for notifications related to each applicable program (e.g. GST/HST, payroll, corporate tax, etc). Regardless of whether the business registers for notifications or even provides an email address, it will still be transitioned to online mail. The presumption of receipt applies regardless of whether the taxpayer receives notifications. Businesses should ensure to sign up for My Business Account to avoid losing access to important CRA correspondence.

Businesses can opt out of receiving online mail (thereby receiving paper mail) by changing their settings in the Profile section of My Business Account or by submitting Form RC681 Request to Activate Paper Mail for My Business to CRA. However, CRA may still provide online-only mail until they finish processing the request. Communications posted within 30 days of a request are still presumed to be received on the day of posting. As such, taxpayers should monitor their online CRA account during the transition period. Requests can only be made by an individual with signing authority, such as an owner, director or legal representative as reflected in CRA’s records.

It is important to ensure that mailing addresses are kept current as undeliverable mail will result in a change back to online mail. In addition, businesses will need to make a new request to activate paper mail every two years.

If paper mail is selected for existing business program accounts and a new account is registered, a new request for paper mail will be required for that account.

Consider whether paper mail or online-only mail is your preferred method of communication with CRA. If you prefer paper mail, ensure to opt out of online mail for all relevant program accounts and monitor your online accounts during the transition period.

The Healthy Way to Hire the Kids

Most businesses have accounting, computer, and vacation policies. Why do so few have family employment policies?

Making decisions about hiring younger relatives can be difficult. Skills and talents may vary widely, or maybe there’s not a job for everyone. And sometimes a family member just doesn’t work out as an employee.

Hiring the kids requires a lot of thought, and the time to do the thinking is before the next generation comes of age. Employment in a family business is not an entitlement; business needs and individual abilities must determine hiring decisions.

When creating family employment policies, consider:

Experimentation: Summer jobs can be a great way for kids to “try out” the family business and vice versa. Create a summer job policy outlining the type of work kids are expected to perform, along with personal learning goals.

Education: Is a college degree required to work at the company? Perhaps a graduate degree in a certain specialty? If so, detail the company’s expectations before hiring family members.

Situation: In what position will the children start? Will they rotate through jobs in a training program? Should they work outside the family business first? Address these questions in writing.

Compensation: Family members should be paid based on fair market value for their job responsibilities. Detailing salary and bonus formulas will help to ensure that everyone is treated fairly.

Performance: All employees, including family members, deserve regular performance reviews. Spell out review schedules and adhere to them.

Separation: It’s imperative to consider a separation protocol for family members. Indicate performance requirements for continued employment, and include specific behaviors or actions that will not be tolerated. Also, specify severance package details.

Human resources issues are complicated. Having formal family employment policies in place can alleviate at least some of the emotion and angst inherited in mixing family and business.

2025 Provincial Budget – Ontario

On May 15, 2025, Ontario’s Minister of Finance, Peter Bethlenfalvy, presented the 2025 Ontario Budget – A Plan to Protect Ontario. The province’s budget includes the following tax measures:

Business Tax Measures

Corporate income tax rates

Ontario’s corporate income tax rates have not changed.

Ontario tax deferral

The budget provides businesses a reminder that the payment of select provincially administered taxes (e.g. employer health, gas, fuel, and others) may be deferred for six months, from April 1, 2025, to October 1, 2025. Although penalties will not apply for missed payments during this period, there is no deferral of tax return filing deadlines.

Ontario made manufacturing investment tax credit (OMMITC)

The refundable tax credit has increased from 10% to 15% on up to $20 Million of eligible investments per taxation year. Therefore, the maximum credit will increase from $2 Million to $3 Million per taxation year. The $20 Million limit must be shared amongst an associated group of corporations and will be prorated for short taxation years. Eligible investments include buildings and equipment used in manufacturing and processing (M&P) in Ontario, that are acquired and become available for use on or after May 15, 2025, and before January 1, 2030.

The credit has been extended to non-Canadian-controlled private corporations (“non-CCPCs”), which have a permanent establishment (“PE”) in Ontario. Non-CCPCs are eligible for a non-refundable tax credit (“NRTC”). Any unused NRTC’s could be carried forward up to 10 taxation years and applied against taxes payable.

The budget includes a repayment of the credit where after May 14, 2025, the eligible capital property is sold, converted to non-M&P use, or removed from Ontario within five years. The repayment amount would be the lesser of:

- The total value of the credit; and

- The credit amount relative to the value of the property at the relevant time.

Ontario shortline railway investment tax credit (OSRITC)

The budget introduces a 50% refundable tax credit for capital property (included in capital cost allowance classes 1, 3, or 13) and labour expenditures on railway-related maintenance made on or after May 15, 2025, and before January 1, 2030, by qualifying corporations. A qualifying corporation must be licensed either provincially under the Shortline Railways Act (Ontario) or federally (class II & III) under the Railway Safety Act and must have a PE in Ontario. The credit will be limited to $8,500 per track mile in Ontario and the labour expenditures are limited to railway track maintenance expenditures paid to individuals who are residents of Ontario for work performed in Ontario.

Personal Tax Measures

Personal income tax rates

Ontario’s personal income tax rates have not changed.

Ontario fertility treatment tax credit

The Ontario government has introduced a new fertility treatment tax credit effective January 2025, aimed at helping individuals with the costs of fertility services. The credit will cover 25% on up to $20,000 of eligible fertility- and surrogacy-related expenses, with a maximum tax credit of $5,000 per year. Eligible expenses include in vitro fertilization (IVF) cycles, fertility medications, diagnostic testing, and travel for treatment. This credit is available in addition to the non-refundable federal and Ontario medical expense tax credits for the same eligible expenses.

Other Tax Measures

Changes to Gas and Fuel Tax

Effective July 1, 2025, the tax on propane used in licensed road vehicles will be eliminated.

Additionally, the Ontario government has made permanent the reduced tax rate of 9¢ per litre on gasoline and fuel, which had previously been lowered from 14.7¢ for gasoline and 14.3¢ for fuel. These temporary reductions were originally set to expire on June 30, 2025.

Changes to Alcohol taxes

Effective August 1, 2025, the Ontario government is proposing amendments to the Liquor Tax Act, 1996 that would reduce alcohol-related tax rates. The spirits basic tax rate would be lowered from 61.5% to 30.75%. For Ontario microbrewers, the beer basic tax rates would be reduced from 35.96¢ to 17.98¢ per litre for draft beer, and from 39.75¢ to 19.88¢ per litre for non-draft beer (with transitional rules applying). Additionally, the refundable corporate Small Beer Manufacturers’ Tax Credit (SBMTC) will be adjusted to reflect these new rates, offering enhanced relief to qualifying corporations for eligible sales occurring after July 31, 2025.

How to Make a Payment with Canada Revenue Agency for Your Business

Online Banking Payments

Make a payment to the CRA through online banking, the same way you pay your phone or hydro bill.

- Sign in to your financial institution’s online business banking service.

- Under “Add a payee,” look for an option such as:

- Federal – Corporation Tax Payments – TXINS

- Federal – GST/HST Payment – GST-P (GST-P)

- Federal Payroll Deductions – Regular/Quarterly – EMPTX – (PD7A)

- Federal Payroll Deductions – Threshold 1 – EMPTX – (PD7A)

- Federal Payroll Deductions – Threshold 2 – EMPTX – (PD7A)

- Federal – Canada emergency wage subsidy repayment

- Luxury Tax

- Underused Housing Tax (UHT)

- Enter your 15 digit business number as your CRA account number.

You are responsible for any fees that may be charged by your financial institution.

Debit Card Payments Via ‘My Payment’

Make a payment with your Visa® Debit, or Debit MasterCard® .

My Payment is an electronic payment service offered by the CRA that uses Visa® Debit, Debit MasterCard® for businesses to make payments directly to the CRA using their bank access cards. The CRA does not charge a fee for using the My Payment service. Credit Cards not accepted with this service.

To use My Payment you need a card with a Visa Debit logo or Debit MasterCard logo from a participating Canadian financial institution.

Before you start ask your financial institution about your daily or weekly transaction limit and any fees for making online payments. The CRA does not charge a fee for using this service.

Pay Through a Canadian Financial Institution

To make a payment at your Canadian financial institution, you will need a personalized remittance voucher. Financial institutions will not accept photocopies of remittance vouchers or payment forms.

You can make a payment in foreign funds. The exchange rate you receive for converting the payment to Canadian dollars is determined by the financial institution handling your transaction on that day. You are responsible for any fees that are incurred.

Arrangements will need to be made with your financial institution if you are making a payment of more than $25 million.

Be sure to provide accurate information to help the CRA apply your payment to the intended account. A personalized remittance voucher will help CRA apply your payment properly. You can request personalized remittance vouchers online or by phone.

Mailing Your Payment

The government released legislation, effective January 1, 2024, that any tax payment or remittance made by a corporation to the CRA exceeding $10,000 must be done through electronic means.

If your tax payments exceed $10,000, you should no longer make these payments using a cheque.

It is highly encouraged to remit payments to the CRA electronically even if the amount is less than $10,000 as electronic payments are processed quicker. This will also significantly reduce the risk of lost or misapplied payments. Furthermore, it is usually far easier and faster for the CRA to trace a lost or misapplied electronic payment than a cheque mailed to the CRA.

If you still wish to send a cheque or money order, make it payable to the Receiver General for Canada and include your remittance voucher. Note: Payment is considered received on the date CRA receives the cheque, not the postmark date.

Mailing address:

Canada Revenue Agency

PO Box 3800 STN A

Sudbury ON P3A 0C3

Payment by Pre-Authorized Debit (PAD)

Set up a pre-authorized debit agreement and eliminate the need for postdated cheques.

Pre-authorized debit (PAD) is a secure, online, self-service payment option for individuals and businesses. This option lets you set the payment amount that you authorize the CRA to withdraw from your Canadian chequing account to pay your taxes on a date, or dates, of your choosing.

Due to the processes that must take place between the CRA and the financial institution, the taxpayer’s selected payment date must be at least 5-business days from the date their PAD agreement is created or managed.

See Federal holidays for a list of non-business days.

There is a ‘pay by pre-authorized debit’ option through GST/HST netfile available for an amount owing.

A PAD agreement can only be set up online, not over the phone.

Steps to create a pre-authorized debit agreement for businesses

To create a PAD you have to be registered for My Business Account. Click on ‘CRA register’ or ‘Continue to Sign-In Partner’ and complete the steps. Once completed, your official access code will be sent to you by mail. Once you enter the access code into My Business Account you will have full access, which allows you to view, create, modify, cancel, or skip a payment.

This option is not designed to be used frequently due to the limitations on payments and the fees involved.

Steps to create a pre-authorized debit agreement for individuals

To create a PAD, you must to be registered for My Account. Once signed in:

- Select the ‘Proceed to pay’ button and select the ‘Pay later’ option to create a PAD agreement.

- Access ‘Manage pre-authorized debit’ under the Related services within the Accounts and payments section to view, modify, cancel, or skip a payment.

- A PAD agreement can also be created within MyCRA, for an amount owing, by selecting the ‘Proceed to pay’ button and the ‘Pay later’ option. Your credentials are the same as in My Account.

Credit Card Payments via Third-Party Service Providers

You can make a payment with a credit card, debit card, PayPal, or Interac e-Transfer by using a third-party service provider.

Different service providers offer different payment methods.

The third-party service provider will send your business or individual payment and remittance details online to the CRA for you.

Ensure that you set up your payment well in advance of your payment’s due date as payment delivery is not immediate, and is determined by the third-party service provider that is used.

Note: Third-party service providers charge a fee for their services. Click here for a full list of third-party service providers.

Payments via Wire Transfer for Non-Residents

Non-residents who do not have a Canadian bank account can make payments to the CRA by wire transfer.

Wire transfers for submitting your non-resident GST/HST security deposit are not available at this time.

What you need to know

All wire transfers must be in Canadian dollars.

Your financial institution may have standard charges that apply to wire transfer payments. Make sure that your financial institution does not deduct the wire transfer fee from the total payment amount due as this will result in an underpayment.

Wire details

You will need the following information to transfer funds to the CRA’s account:

| Name of banking institution: | The Bank of Nova Scotia 4715 Tahoe Blvd Mississauga, ON Canada L4W 0B4 |

| SWIFT: | NOSCCATT |

| Bank number: | 002 |

| Transit number: | 47696 |

| Canada Clearing Code/Routing Code: | //CC000247696 |

| Beneficiary name: | Receiver General of Canada |

| Beneficiary account number: | 476962363410 |

| Beneficiary address: | 11 Laurier Street Gatineau, Quebec K1A 0S5 |

| Description field: | Authorization number: 12226367 + your CRA account number and details |

| Charges field: | “OUR” |

To avoid processing delays include the following information with your wire transfer:

For Businesses:

- non-resident account number or business number

- business name

- period end date

- fiscal year

- telephone number

- return/remittance

- Provide a copy of your tax remittance or GST/HST return/remittance by fax to the CRA:

- Attention: Revenue Processing Section

- Fax: 204-983-0924

- Provide the amount paid, the date paid and the confirmation number if available

Avoid late fees

You are responsible for making sure the CRA receives your payment by the payment due date. If you are using a third-party service provider, please ensure that you clearly understand the terms and conditions of the services that you are using.

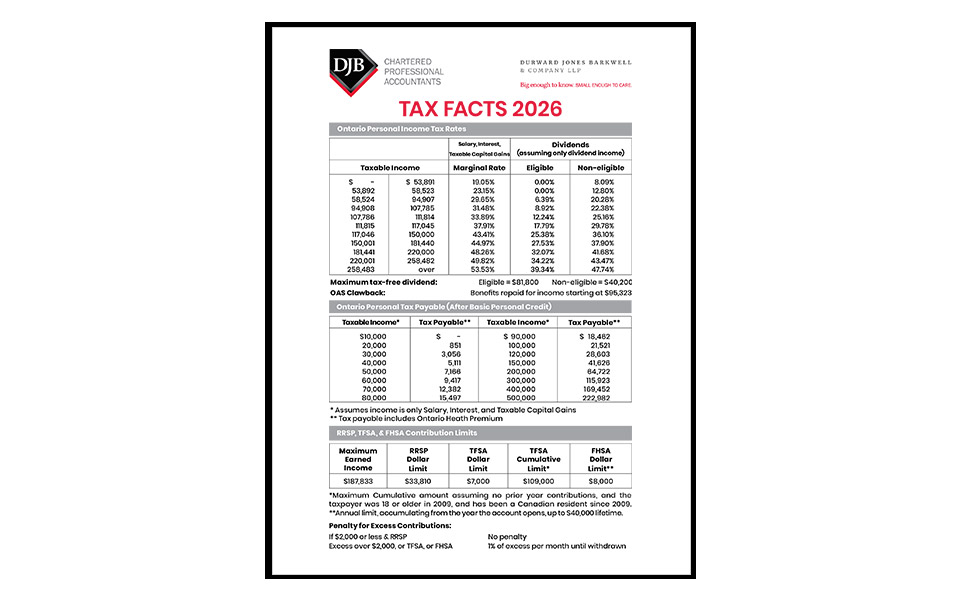

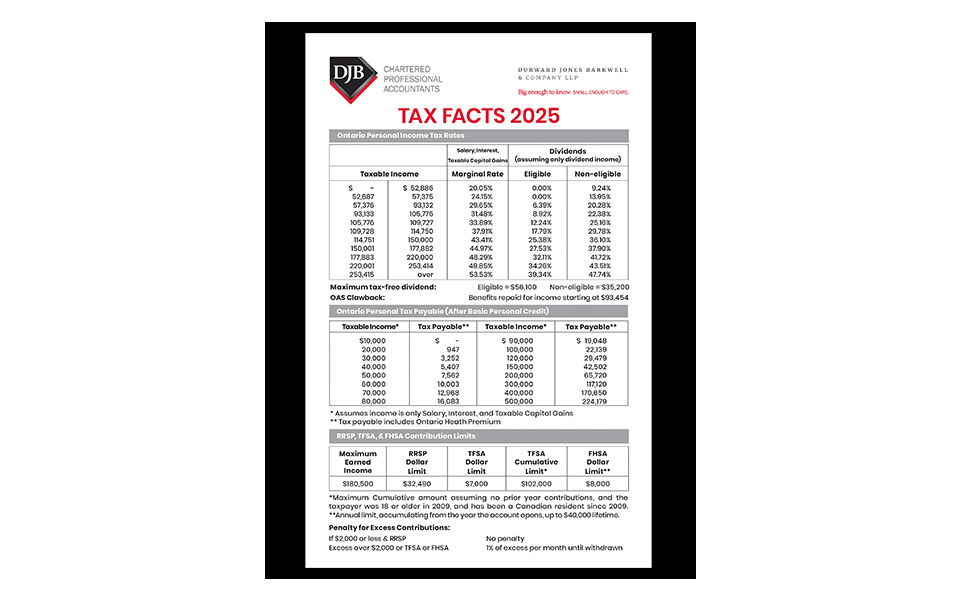

Tax Facts Card – 2025

How Does GST/HST Apply to Airbnb/Short-term Rentals?

The popularity of Airbnb, short-term rental pools for cottages and vacation properties continues to grow. One aspect of venturing into the short-term rental game is how GST/HST applies. The volume of rental income and the length of the rentals is the determining factor on whether you will need to charge GST/HST.

Essentially, long term-rentals are exempt from GST/HST, while short-term rentals are subject to the tax.

What is considered a short-term rental?

A short-term rental is generally one where the period of occupancy is less than one month and the consideration for the supply is more than $20 a day.

Am I considered a small supplier?

If you are supplying short-term rentals, you will need to determine if you are considered a small supplier for GST/HST purposes. A small supplier is one whose worldwide annual GST/HST taxable supplies, (including zero-rated supplies and including the sales of any associated parties) are less than $30,000, or less than $50,000 for public service bodies (colleges, non-profit organizations, charities, hospitals).

One of the most common oversights we see is forgetting to include any other associated business revenue into the small supplier test.

Should I voluntarily register for GST/HST?

If you are under the $30,000 of taxable supplies for your associated group, you can elect to voluntarily register for GST/HST. The benefits of this would be to enable the claim of any GST/HST paid on expenses related to your short-term rental income. It may also permit you to recover some or all of the GST/HST you may have paid on the unit.

But be aware – if you choose to register, you will be required to collect and remit the GST/HST on your short-term rental income.

There are many factors to consider when venturing into this market; especially if you will be using a portion of your principal residence.